20220728

What is the better design for the US CBDC digital dollar ?

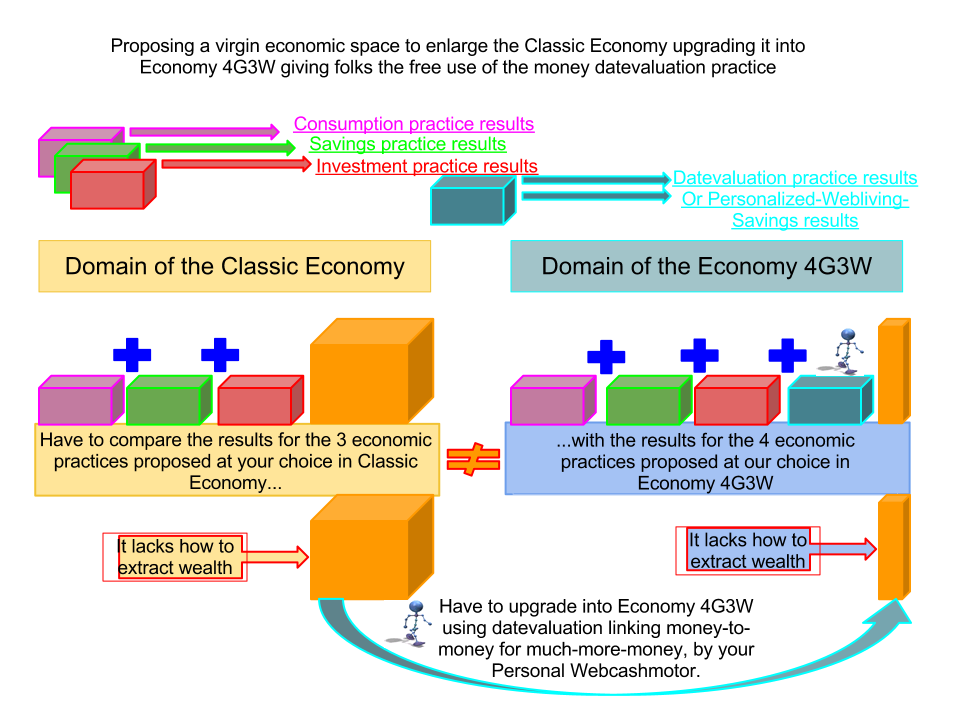

The economy-4g3w aims to become an upgrade to the Classic World Economy giving humans the opportunity to add the economic results of the money data-valuation practice, to the results of the other 3 economic practices, consumption, savings and investment which total result expresses the Economy as it was possible and limited before the Internet. Internet in standards of W3C brings the space, the dynamic and the ever evolutive production factors for humain exercise the money data-valuation practice in order to extract wealth from a virgin infinite resource.

So data-valuation requires the Internet to deploy effects that are results of individual activity over the money in digital form and maintaining it cash phase (#cashkeeping phase) that lives in reversible form of personalized digital savings.

It's this shifting of the fiat money asset into the monetary property asset of 1 digital object for each US$ 10.- (merged with the timestamp of creator's action), results in the Personalized Digital Savings is accounted with metadata and time and produces efects for the ownership creator.

Enabled people can create digital savings (US Fed's CBDC or digital UUS$$) using a PSH-Personal Savings Helper app delivered by WUW, The Webcash Universocial Web by a free inscription of the personal identity on WUW's Registry General Ledger that triggers and grants de license with personal habilitation by app identifier delivery.

From download allows the user to merge time as a commodity with the allocated money for datavaluation and the all the activity results are accounted anchorized at The Universocial Sovereign Anchor as digital objects in sharing cash production monetary work with saved guaranty in cash phase. Here at the Sovereign Anchor the dynamic generation of time-at-work metadata further of quantitative cash production to share day results, produces also the seniority coeficient which is the point of origin on added value formation on the body of each #owndated-webquantum.

Having shared on cash production, the digital savings units (each of them a singular digital object) go on coexistence at T.O.M. The Time Owned Market for financial work. Here all digital objects (supposed digital dollars objects) are units of capture of shared cash results. First using luck to random for their owners cash results : 100'000 digital units take each day all 80% of the TotUnixTimeCashCake ; after ordonating by seniority coeficient to fix the cash quantity for each one of the lucky 100'000, from the older to the younger slices results decreasing and are #webcashmatic payed after #webtaxmatic liberation with TIGTA inspection and freedom on personal cash results .

At the end, the last but not the minor, at The Time Owned Market there are organized one Bid & Ask on cloud market displayed at the screen of each do-g-phone (where there are a menu for time-at-market orders and for #tagvaporation uses). For the user it's the opportunity to sell time and other metadata contained on each digital savings object. This is the advantage to make capital gains without having take a risk and far of cash phase like it has been the compulsive obligation on investment practice in the tradicional Economy. This compulsive obligation to enrich is solved by the money data-valuation here proposed in economy-4g3w (4 four gestures in Internet www) .

20220727

The money data-valuation is the egg of Columbus

The use of the data-valuation practice aims to give people the opportunity to act over the money keeping it phase cash along computacional algorithm treatment to obtain #webcashmatic results in mode #webtaxmatic.

The algorithm is proposed by WUW The Webcash Universocial Web to be runned by Google Cloud Platform working on all the four parts of money, after shifting it asset into personalized digital savings in property asset and allowing to extract wealth in cash from entire money body :

1. from it monetary part ;

2. from it financial part ;

3. from it spiritual part ;

4. from it taxmatic part.

The money data-valuation is an economic upgrade and should work with the other three money practices : consumption, savings and investment.

With data-valuation people starts in Economy 4G3W (4 gestures in WWW).

20220725

Requesting the US Admnistration and in particular, The US Fed

Requesting the US Administration and in particular, The US Fed, the individual legitimity reconnaissance to praticate of the money data-valuation.

Because US dollar data-valuation gives folks liberty to operate all four parts of money body, upgrading personal economic performances, resolving the Penrose triangle limitation :

Money you spend for live, money that you can't save and money you neither can invest ;

Money you save for safety, money that you can't invest and money you neither can spend ;

Money you invest for reproduction, money that you can't spend and money you neither can save.

This limitation has not only a bad consequence economic performances, the worst is the regret for a bad choice and the development of feelings of guilt, often leading to introspective shyness and even chronic psychological illness.

Now on Internet Era evolution, the US Lawmakers should frame the personal right to shift the US dollar asset into personalized digital savings activated with internet dynamics. Hugging the design of Fed's US CBDC or US digital dollar, even one UUS$$ prepared for universocial digital dollar on world markets. Money on folks hands with four processables parts working in Internet for people wellbeing upgrading our Classic Economy making the data-valuation of the US$ and creating the US CBDC .

20220723

Predictive app for the creation of US Fed's digital dollar CBDC

More Recent Articles

- Should Google accepte the challenge to launch the money data-valuation practice giving substance to the US Fed's CBDC ?

- Concepts for US CBDC

- 2. Could some or all of the potential benefits of a CBDC be better achieved in a different way?

- 3. Could a CBDC affect financial inclusion? Would the net effect be positive or negative for inclusion?

- 4. How might a U.S. CBDC affect the Federal Reserve's ability to effectively implement monetary policy in the pursuit of its maximum-employment and price-stability goals?

It's time to monetarize time from your digital savings

20220719

Should Google accepte the challenge to launch the money data-valuation practice giving substance to the US Fed's CBDC ?

The money data-valuation aims to be an economic practice allowing people achieve the constitution of personalized digital savings.

Personalized digital savings could be created as digital objects in property asset of their creators or of their sucessives owners having adquired at a later date the evolutive rights by transaction among the living or by cause of death.

What are the economic solution that could be resolved by the use of the money data-valuation practice and by it digital savings product ?

The economic solution is on the mode to obtain capital gains from the money in savings phase. The money data-valuation is a practice that starts from using cash, for cash interest production to share cash results every day.

The money data-valuation is available in Internet space. It uses a "PSH-Personal Savings Helper" app to run an algorithm to be conduct by Google Cloud Platform service that :

- Works in cash phase for results in cash phase ;

- Delivers day #webcashmatic results from all 4 utilities of digital savings properties ;

- Delivers freedom by it #webtaxmatic function inspected by TIGTA.

20220718

Concepts for US CBDC

The technologic problem of the creation of the US CBDC is a false question.

The problem was the conception but now it is understable that:

For people the liberty to be able to shift the asset of the US dollars into the personalized asset of the US digital dollars, brings the opportunity to make digital savings containing in it substance all the set of money’s utilities : monetary part, financial part, spiritual part and taxmatic part. So the US Fed’s CBDC got people’s preference and the US digital dollar succed sucession of US dollar.

So the design proposed to FED requires W3C’ and Google’ wills. Both working for people welfare.

And this sentence resolve all the design because it clarify that the US CBDC has to take origin on people’s needs and wants. To satisfy persons. All persons, not some.

So the design proposed to FED requires W3C’ and Google wills for the creation of a web cash for economic upgrade introducing the practice of the money data-valuation.

At WUW The Webcash Universocial Web we are proposing to Google and the United States Administration through the Fed, the launch of the United States CBDC using a simple design that manages to merge time as a commodity in the US dollar turning it into digital saving.

Giving people the ability to exchange money into a personalized asset in the form of a cash-producing cell anchored at The Fed = would become the US Federal Reserve’s CBDC.

Then at T.O.M. The Time Owned Market all webcashmatic results are distributed every day at 12:00, under TIGTA inspection.

20220707

2. Could some or all of the potential benefits of a CBDC be better achieved in a different way?

2. Could some or all of the potential benefits of a CBDC be better achieved in a different way?

Filipe's answer :

The benefits that should be achieved with the launch of the US CBDC may be more important than those considered in your January 2022 paper and be specific to the Universocial US$$ of the FED, by introducing the notion of an automatic work on the data of the money to be created as 1 by 1 digital objects with unique characteristics and just shifting the asset from credit-debit balances to digital property asset registered at a sequencial historic general ledger.

The notion to be introduced and already tested is the processing of money in different parts of the body of the digital object.

Indeed...

Let us inject time into the money, fusioning both with the creators identity of digital savings objects.

That shifting asset action (data-valuation) could let people go cash sharing the production of cash results (distributed every day), using Android app to personalize dynamic savings and to trade timestock in savings in production of interest generating capital gains by Fed's anchorized production fabric in universocial web space.

It's the WUW's algorithm runned by GCP with agrement of W3C, US Admnistration and Fed as co-issuer-legitimator.

3. Could a CBDC affect financial inclusion? Would the net effect be positive or negative for inclusion?

3. Could a CBDC affect financial inclusion? Would the net effect be positive or negative for inclusion?

Filipe's answer :

Considering in the first place the possible launch of the US CBDC as a liability of the central bank and fearing multiple launches of similar CBDCs, I have the intuition of certain storms in the field of financial inclusion where the US dollar digital presupposed in your paper of January 2022, even if with unmistakable value support, it may lack the simple features that I see in the launch of USA FED's CBDC or Universocial US$$ giving it in a way linked to the value support:

- as cash production cell (1st monetary part processable as personal savings growing advantage ) +

- a counter @stamping of the time in production of the cell and its antiquity in the production of distributable wealth (2nd financial part processable as capital gain as the time go) Time Market Bid & Ask +

- a webtaxmatic cloud function as a release value of the webcashmatic income of the new taxable amount that the US Treasury thanks (3rd part processable as "freedom" gain) +

-a tagvaporator of the personal orientation option for the free exercise of the owner of the digital object UUS$$ regarding the eventual limit destination (democratic folks control of investments) of the monetary load allocated in the "Universocial Sovereign Anchor" which production is distributed every 24 hours (4th part processable as "multiplicative capacity" gain).

|

20220706

4. How might a U.S. CBDC affect the Federal Reserve’s ability to effectively implement monetary policy in the pursuit of its maximum-employment and price-stability goals?

4. How might a U.S. CBDC affect the Federal Reserve’s ability to effectively implement monetary policy in the pursuit of its maximum-employment and price-stability goals?

Filipe's answer :

The launch of US CBDC designed as "...a digital liability of the Federal Reserve that is widely available to the general public" could affect the Federal Reserve's ability in the pursuit of its maximum-employement and price-stabilitty goals.

Because such CBDC would not be USA genetic but one more CBDC and would lack not only of an underlying asset pool as the others even not so important for United States of America and it futur digital dollar but moreover it lacks of an underlying construction to enable folks on ability for wealth creation and extraction from the virgin space self dimensionable with UUS$$ and a fixed interest rate for the cash production to be shared to get rights to share cash results every 24 hours.

Estas lacunas evendenciam dúvidas sobre todas as cryptos and less but also sobre all CBDCs as it's coming before me.

In my proposed design of FED's UUS$$ for United States of America the "digital liability" would be "FED's disponibility of economic spaces for anidation of central bank money in web dynamics production" creating conditions to generate a stream of money now again towards the FED !!! and to rearrange the Universocial Economy.

Now the Federal Reserve’s ability to effectively implement monetary policy in the pursuit of its maximum-employment and price-stability goals, could be better performable with the introduction of the Fed's U.S. CBDC in reason the dynamic exudation of new smart tools contained on it substancial nature and generators factors for quantitave issuance.

On my design, Fed (if not before, a Fed's onecompetitor ) might create a monetary-financial magnet in form of an unit (a factory) of interest production from US$ 1Trillion cash accumulative by the persons who could be interested to share on that production (linking money), against [guaranted cash results distributed every day, + the hopes with day capacity to multiply + certainity of capital gains as the time go].

Giving folks the right of revert it action of money data-valuation gesture. The thing substantiate and motivate as in any case, personalized digital savings guaranted by The Fed.

The sketch of the US CBDC design pleases but seems unrealizable.

The fact is that US Fed can achieve the launch of the US CBDC, the digital dollar with unique and exclusive virtues.

The American CBDC shall be unreachable for the competent on the present and on the future, because designed and defended for universocial well being.

Nota Bene : on the WUW's algorithm the initial capital of 1T US$ to constitue The Universocial Sovereign Anchor is designed as coming from Fed ( may be with anidation or accounted as active or as passive at US Treasury) contains an irrevocable obligation to phase out to zero. From zero, The Fed becomes free of that obligation and can decides about the opportunity to use it own PSH-Personal Sav

5. How could a CBDC affect financial stability? Would the net effect be positive or negative for stability?

5. How could a CBDC affect financial stability? Would the net effect be positive or negative for stability?

Filipe's answer :

It would be positive or negative for stability in dependence on the CBDC design.

I would trust a UUS$$ as FED's codificated spaces to be created at the General Ledger of The Webcash Universocial Web" as FED's authorized spaces for anidation (reversible allocation) of folks monetary burdens who use the PSH Personal Savings Helper for the practice of the money data-valuation.

US CBDC as FED's a liabity would not be great to resolve inflation and USA Debt ( no so important I agree but would prefer an organized in inflation compressor and investment resources cash stream for people wellbeing and to maintain USA leadership.

Now, what should be the meeted brain point to judge for US Fed's final decision when looking on the designed and proposed standards on one US' CBDC with positive factors of stability ?

The Fed's Board of Governors has done a choice over the stability factors prefered by politic options framed by actions compatibility.

In front of the set of commands in evolution at The Fed, the creation, the adoption and the launch of the US CBDC, should accept a design with a mix of stability factors in accordance with independent intrinsics panel of economic influencers elements :

- towards positive impulsion economic effect :

adoption value , 40% ;

- towards positive impulsion competitive effect :

adoption value, 20% ;

- towards positive impulsion of desinfection effect :

adoption value, 40% ;

Analizing the nature of the design along proposed in concordance of this panel of values for adoption and launch, it is possible to infer that the net effect of Fed's CBDC launch would be positive, even though despite the initial winds caused by massive popular support.

20220704

6. Could a CBDC adversely affect the financial sector? How might a CBDC affect the financial sector differently from stablecoins or other nonbank money?

6. Could a CBDC adversely affect the financial sector? How might a CBDC affect the financial sector differently from stablecoins or other nonbank money?

Again in dependence of the CBDC design.

A design where the US FED authorize the use of an infinite number of it coded spaces for anidation alphanumeric and @stamped of monetary burdens to be provided of WUW's algorithm for the money data-valuation reproduction seems the opportunity to serve USA with a pioneer central bank currency driver included the processed money pumping by Google Cloud Platform in stream for the Universocial Sovereign Anchor of shared cash production at The USA FED and with cash results every 12:00 at New York local hour at The T.O.M. The Time Owned Market.

Could a CBDC adversely affect the financial sector?

Adaptations with upcoming reaction events would be daily webmatic treated by the total transparence of the WUW The Webcash and The T.O.M. The Time Owned Market and all insuered by Google's Technical Structure.

Bearing in mind the principles to be followed in order to achieve the set of solutions required for the general satisfaction of social, economic and political needs, the design of the US Fed CBDC cannot deviate from the one I present to you.

So much so that the best thing would be to start with a working group to prepare the post-test M.I.T. and in secrecy.

In fact, the needs to be satisfied cannot wait:

As for individuals, legal entities and even entities, in the social sphere:

- How can budgets be used in order to live?

- How can growing investment needs be met without promoting popular savings and without having to remunerate them with the highly inflationary "interest rate instrument"?

- How can you start and achieve the disinfection of money "separating the wheat from the chaff"?

- How can you restore a balance between the monetary and the financial to people?

- How can people be given happiness and freedom by encouraging and supporting them in economic life?

As for the economic ones and as for the issuing institute:

- How can the Fed's US dollar be maintained and hegemonized?

- How can investments be fed without having to create currency in a hyperbolic trend?

- How can commercial banks and central banks that are not in line with the US Constitution be put back at the service of the society sheltered by the US army?

- How can infinite wealth be extracted from an Internet Web space?

- How can the US$ be digitized without disturbing and without harm?

As for the policies and as for the US Constitution:

- How can an advantageous CBDC be regulated to progressively replace the US dollar?

- How can we ensure that the framework for the "legal trend" is fair and comprehensive in terms of the existing socio-economic, monetary and financial structures in the pre-launch of the new digital currency?

- How are the elements of the US CBDC eligible as tax makers and what are the supervisory bodies?

- Must the law authorize the Fed to use Google's infrastructure

for services inherent to the issuance, operation and automatic computer circulation, including tax refunds to taxpayers from other countries?

- The legislation must be designed with a provision on a confidential basis for a launch that may come as a surprise to the Market.

In fact, I present to you here the ingredients of the solution

1. Liquidity preference, the solution is "#cashkeeping" ;

2. Satisfying "needs and wants", the solution is "#webcashmatic" ;

3. Being a producer of daily results, the solution is time for action;

4. Being a wellness producer, the solution is "#webtaxmatic".

The structure that should support the proposed design for the launch of the US CBDC requires:

To the founding by the Fed and the acceptance of the US CBDC design,

1. Formation of Universocial Sovereign Anchor" with 1 Trillion US$ serving as a cash production device for daily distribution and as a temporary magnetic magnet offered publicly to share results on an individual basis from "sharing cash production" to "share cash results every 24 hours", and :

in the broadcast,

- At the decision point of the CBDC issue: people practicing "the money data-valuation" using the Android app "P.S.H.-Personal Savings Helper", change the asset from US$ 10.- to a digitally owned asset = 1 Owndated Webquantum that contains the name of the creator combined with the monetary charge and with the timestamp of the property created with authorization from the Fed and assisted by the WUW The Webcash algorithm with internal and external Google Cloud Platform service with W3C agreement and performing general execution from end to end including the postage of round trips, to Mercado do Tempo, the Bid & Ask service, transactions, delivery of payments, always in the #cashkeeping phase and the performance of functions in the #webcashmatic and #webtaxmatic modes.

Now finally answering your title question:

The inconveniences and disturbances will have repercussions on the monetary and financial markets, which will see a decrease in the income derived from the current issuance system by Tbonds.

The advantages for all are found in the improved Economy with the practice of "the money data-valuation", its infinite benefits for all, its instrument for producing an interest rate forever fixed at 2%/day/365 payable every 24 hours, its power to create an unenforceable fiscal mass.

20220702

7. What tools could be considered to mitigate any adverse impact of CBDC on the financial sector? Would some of these tools diminish the potential benefits of a CBDC?

Filipe's answer :

The tools are considerated in standards of the USA FED and could insure full succès for implementation and to run the W3C Internet, drived in handleling by Google's Tech Services :

- Draft protocoles and execution agreements ;

- Regulations of US Congres ;

- Creation of FED's codes for authorizing anidations at the WUW's

General Ledger ;

- Implementation of WUW The Webcash Universocial Web ;

- Creation of the T.O.M. The Time Owned Market ;

- Creation of the app P.S.H. - Personal Savings Helper ;

- Creation of Do-G-Phones specifiques for to run PSH app ;

- Testification phase at MIT.

- WUW's notary documents for operations over digital properties "Owndated Webquantums".

.../...

Some of the tools included on the process of constitution of personalized digital savings which is the lead wire (linking money-to-money by do-g-phone, on organized production cash shared, adding time in cash keeping phase to share cash results in #webcashmatic and #webtaxmatic modes) thanks to the creation and issuance of the digital dollar, with the two merged wil and synchronized on independent actions that starts with 1 personne (agent economic on firts kickoff creation step), goes to the US Fed ( 1 admnistrative institution for Monetary Policy Implementation) to offer integration on political directional needs asking authorization for monetary allocation with anidation for cash production at the Fed's dependent Universocial Sovereign Anchor.

A - The synchonized wil of both (folks each individual + US Fed's)

- by [(1 person in monetary covering action for webcashmatic & webtaxmatic results)

+

- by (1 institucional person US Fed's anchorizing cash production)] + WUW's (service of identity registration + data-valuation algorith + app delivery + running BPaaS on included internal service GCP IaaS by WUW's / Google / W3C protocol)] :

B - The 3 service providers :

- by WUW The Webcash ( service for beneficiary legitimation + P.S.H.-Personal Savings Helper deliver a+ algorithm running on BPaaS for the practice of the money data-valuation)

a+

- by T.O.M. The Time Owned Market (service of day results distribution

Sumission at TIGTA's inspection + service Bid & Ask on time market+ capital gains payments + WUW's Office of Regular Certifications)

+

- by Google' IaaS computation energizer and handling of general algorithmical executions enrouting from start inscription to the complete circuit of money parts and delivery of cash results depurated from tax obligations.

N.B. In order to assess the negative effects of a US Fed's CBDC, it is necessary to know the final design that will be adopted for launch. Staying in Classic Economy and refusing the money datevaluation as a mean to make capital gains without risk which practice is the main reason to defend the money data-valuation as an alternative investment substitute justifying the upgrade into Economy $G3W (four gestures at internet space) , it's not possible for me to answer in that past landscape.

Even so, uncertain as to your final choice, and yet without envisioning the principles adopted for the final design, I will venture to write an answer referring to the fundamental dangers and disturbances-or-not (when to arrive at the digital currency that would be the Fed's US CBDC, without incorporating time and without counting it in economic production, without a visible processing structure and used by the general public and sending 3-Stamp Economy and pre-internet) that I feel solved in my proposed project and that I do not see solved in another CBDC of US by Fed, whether it is before or after the others already in circulation and or still in classic preparation. Then answer for solutions that your CBDC would provide:

01. How does CBDC resolve the issue of savings sterility?

02. How does CBDC solve, cementing and fueling investment and it pressing needs for accelerated growth?

03. How to solve a CBDC, the interest rate versus inflation pair?

04. How do you resolve the costs and unattractiveness of government bond issues?

05. How does the CBDC, the control of commercial banks, resolve?

06. How does the CBDC solve, the necessary disinfection of the currency?

07. How is the CBDC resolved, the competition against US$ ?

It will be developed.

20220701

8. If cash usage declines, is it important to preserve the general public’s access to a form of central bank money that can be used widely for payments?

8. If cash usage declines, is it important to preserve the general public’s access to a form of central bank money that can be used widely for payments ?

Filipe's answer :

Yes it's important to preserve the general public access to a form of central bank money.

.../...

Attending to with the growing trend in the decrease in the use of cash, to the general preference pour la phase liquide when in safety, reliability and reversibility the creation of the digital dollar as the Fed's US CBDC has to preserve the general public’s access.

The US Fed's digital dollars to facilitate payments is advocated in the design proposed and discernible at set of answers hereby. Nothing better than a do-g-phone in folks handswith P.S.H.-Personal Savings Helper app because the dollars quality as been shifted into now reversibles digital dollars working in burden-allocation-covered cell cash , to make monetary production of cash, and are now digital dynamic properties with permanent acessibility by on-line owners.

The digital dollars (Owndated Webquantums as advanced US Fed's CBDC) Google' processed with The Fed and The Universocial Sovereign Anchor, with The US Treasury through The TIGTA, The Webcash WUW and The Time Market T.O.M. populate the Internet Webcash space insuring the personal Business Process as a Service in #cashkeeping phase and in the modes #webcashmatic for owners' income and #webtaxmatic for freedom and wellbeing.

All persons users of data-valuation dispose of it processable money in digital savings properties linked at The Universocial Sovereign Anchor, also at The Fed and also with a set of named entities here up .

N.B. : The processable digital dollar, works for all executions and self displayable flash position accounts using the verification of concordance of output resuls calculated on multi-synchonized-machines with independent standards of technology. Make'em go cash. Make me go digital cash.

20220629

9. How might domestic and cross-border digital payments evolve in the absence of a U.S. CBDC?

Filipe's answer :

That if absence of a U.S. CBDC.

Now considering one U.S. CBDC acorded between The FRB and Alphabet-Google with both acceptation of the schematique Filipe's design, with W3C standards as agreemented roof with the founders of WUW The Webcash and Time Owned Market on W3C standards, so :

Domestic and and cross-border digital payments could be made by titularity by endorsement of ownership in the historic accounting record of the WUW The Webcash Universocial Web `[benefiting from its internal protocol with Google] with update on the change of the BPaaS-Business custom's on wuw service Process as a Service (GCP by WUW).

It could give full satisfaction for both Fed-BIS and for folks users of the money data-valuation practice allowing the creation of Personalized Digital Savings properties (Owndated Webquantum) processables further than the clasic payments limits (the us fed's digital dollar could bring to the world "the notion of dynamic payments with in board shift asset".

20220628

10. How should decisions by other large economy nations to issue CBDCs influence the decision whether the United States should do so?

10. How should decisions by other large economy nations to issue CBDCs influence the decision whether the United States should do so?

Filipe's answer :

Agreements are allways the better solution even with the smallest nations.

.../...

The US decision to launch a CBDC is further a consequence imposed by the economical technology evolution, by the human uses of comunication and the fiduciary provisions around unstopable investments than a question of conjunctural competition between nations.

So I trust on US decision launching an upgraded and enriched CBDC in it conception. But the US decision will be generated at the Fed, then regulated and approuved to be isued without further delay.

The other nations CBDCs, or even those of 1 or more economic zones (in potential) could stay more and more unprefered in front of a dynamic and powerful US dollar, now in digital format, running by the "Google Cash Search" engine, served in the hands of the people who want personalized digital savings to be valued on the web and always cash available at no cost, containing monetary, financial, freedom qualities taxmaticas with free dynamic web bringing a multiplicative capacity in monetary personal hope achievable day by day even at millions in cash. All with the certainty of being able to trade increasing capital gains as time goes by increment of the cash production-day-distributed by do-g-phone function linked at T.O.M. The Time Owned Market.

The design proposed for the Fed's UUS$$, would contain one active liquidity of the personalized savings that should be modulated in the areas of ethics, economics and politics because this digital dollar would contain one overcoming attraction self generated (over the world's monetary liquidities) which coud (if modulated) resolve inflation for good.

Also the launch by US Fed of this future digital dollar with this visible and understandable design along the 22 answers gathered here as elements for tests facilities on the MIT @mitDCI (Digital Currency Iniciative) and at the Boston Fed or at Banque du Canada at least and before others laboratories. The launch should make available open and multinational scoped smart contracts for draft ongoing agreements.

Because even if the webtaxmatic function would had to be operated at USA by US Treasury the justice in terms of fiscality tax scope would be preserved.

20220627

11. Are there additional ways to manage potential risks associated with CBDC that were not raised in this paper?

11. Are there additional ways to manage potential risks associated with CBDC that were not raised in this paper?

Filipe's answer :

PSH-Personal Savings Helper should be an app whose Android construction follow the WUW's specifications

The specifications whose specifications are in the pre-beta phase and the list of steps to be programmed for the execution of the WUW The Webcash algorithm are open, due to the proposed protocols and still in the #googledepending phase for #determination of Google-Alphabet / W3C.

These protocols proposed by the WUW to GOOGLE are bilateral and tripartite agreements including the respective "standards" partially dependent on the will and legal frameworks (part of them in the future phase of the votes of the US Senators.

All of this is assumed in the highest level of security under present conditions and in the potential landscape associated with the launch of the US Fed's CBDC supposed UUS$$ digital US Fed's dollar digital in the form proposed here of a digital object to be created from the need to remunerate the savings of vigorously through the innovative path of automated gains both in capital gains and in the hopeful gains of a multiplier capacity in everyday life that serves the "Savings Helper" function (perhaps the function with the greatest curative and propelling consequences of the Economy).

Returning to the protocols , it can be seen that the actors requested by the Author and the WUW are:

1. Google-Alphabet (technical structure, service and evolutionary guidance;

2. W3C (standards and foundational requirements for "the webcash" and "the time market");

3. US Admin (US Treasury - Tiger - US Fed for regulations and individual authorizations for issuance);

4. Results appliance every day at T.O.M. The Time Owned Market : insuring the functions #cashkeeping, #webcashmatic and #webtaxmatic payements e o fornecimento das certificaçoes do WUW's Office for Public Certifications via personalized B.P.aaS conduct by Google .

20220626

12. How could a CBDC provide privacy to consumers without providing complete anonymity and facilitating illicit financial activity?

12. How could a CBDC provide privacy to consumers without providing complete anonymity and facilitating illicit financial activity?

Filipe's answer :

Giving people the opportunity to create their own processable digital CBDC by anidation of monetary burdens in the spaces authorized by The US FED.

.../...

On my projected design the US Fed's CBDC (proposed as UUS$$ - Universocial US dollar digital ) the risks of illicit financial activity are treated allong on pregnating process (creation process) to give birth to each UUS$$ Fed's digital dollar :

Identity treatment by WUW's inscription phase and app downloading :

Each person have to provide identity on basis of Google's verification included in the service for BPaaS (protocol WUW-Google) on kick off WUW's ledger registration for getting the money data-valuation ability. The configuration of the Personal Savings Helper app has to be delivered and it requires verification identity at the moment of downloading at Play Store.

Identity treatment by Google included in the BPaaS (protocol US Fed-Google-WUW_licence_in_formation), on each bid to locate dollars-in-burden as production cell linked to the Universocial Sovereign Anchor.

Identity treatment on US Treasury on WUW's algorithm steps for #webtaxmatic function.

Identity treatment on WUW's algorithm steps on Google Pay execution of BPaaS payment of #webcashmatic whole results that could happen day after day.

The digital dollar UUS$$ even if being each one, = 1 Owndated Webquantum digital object in recorded nominatif property and

containing a monetar savings burden of US$ 10.-, and even it is treated as known ownership property, it titularity as only deserved by the WUW's Office for Public Certifications to give service for owners endorsements.

The treament against the illicity financial activity has been one of the reasons that justify the proposed UUS$$ digital dollar design concept separating in WUW's algorith and according with the 4 utilities into the money's body, the organic 4 parts related with it genetical elements and giving to each of them different wings for computacional processing to deploy the 4 squized juices as all 4 categories of advan :tages for folks using the money data-valuation pratice.

Because the US Fed's UUS$$ dollar digita have to give folks the monetary advantage, the financial advange, the taxmatic advantage and the spiritual freedom for well-being.

The treament against the illicity financial activity has been one of the reasons that justify the proposed UUS$$ digital dollar design concept separating in WUW's algorith and according with the 4 utilities into the money's body, the organic 4 parts related with it genetical elements. Acknowledging them and giving each of them different wings for computational processing to implement the 4 squeezed juices as the 4 categories of advantages for people using the monetary data-valuation practice impulsing conditions for isuance of US Fed's digital dollar.

20220624

13. How could a CBDC be designed to foster operational and cyber resiliency? What operational or cyber risks might be unavoidable?

13. How could a CBDC be designed to foster operational and cyber resiliency? What operational or cyber risks might be unavoidable?

Filipe's answer :

Let Google answer by protocol with you.

No proble at all about that, and no costs for anybody. Because the CBDC UUS$$ could be designed for virgin wealth extraction with payements retained at the source making the thing free for everybody I said.

To enlarge the answer I have to schematize my propose of design for US Fed's CBDC digital dollar :

The instrumental design to support the offer of a new economic practice, allowing the achievement of added value and a simultaneous multiplicative capacity on the money kept in a liquid phase in a secure base in an active resource of recoverable savings that is always accessible, is proposed without deviation from the constitutional legality of the free world and observing in particular the legal principles in force in the USA considering its advance in the development of social sciences as a support of predictability on the presentations to future legal frameworks motivated by pioneering human activities and discoveries.

That considered, it is better to understand that currency situations, market situations and the more specific situations of computational technological scope and other Silicon Valley and other university sources, influenced and influence (quantum computing, tetraneutron discovery) the proposal for the launch of the UUS$$ as the US Fed's digital dollar to serve the people and to solve the economy introducing the money data-valuation practice to substitute, when running, the investment excluding risk and the complexity.

In this ideological and laboratory overview, the design instruments suggested here as an indication of the way, contain a formation with a quadripartite contribution for unified issuance at the US Fed:

- the "personal agent" as an intelligent user stands dosing agent of quantities and values to satisfy "needs and wants";

"It would be THE PEOPLE";

- the "digital currency issuing sovereign agent and anchorized production" as a political-administrative servant;

"It would be US ADMIN AND THE FED";

- the "conductor-supplier agent IaaS including @UnixStamping comparator"as constructor-energizer of pipes and pumps for the 4 processable parts of money;

"It would be ALFABET AND GOOGLE";

- the "space agent" as an Internet-of-currency and standards server.

"It would be CONSORTIUM W3C";

with two concessions or partnerships, would be:

The first would be for WUW The Webcash Universocial Web, ensuring free delivery of the PSH-Personal Savings Helper app with smart-contract-registration-function-certification links, including Timestock-flash registration (account extracts in 9 counters with display on the do-g-phone) with the @timestamp result from the @GoogleStamping comparator.

The second would be for the T.O.M. The Time Owned Market with permanent TIGTA inspection for attribution, fixation and payment of "#webcashmatic" day results from the daily production of #Universocial-Sovereign-Anchor and organization and functioning of the time market under continuous Bid & Ask conditions.

20220623

14. Should a CBDC be legal tender?

Filipe's answer :

No doubt.

Nonetheless [the legal tender of this US CBDC which childbirth of each unit is proposed with a design involving multiple synchronized actors to achieve give controled live to this CBDC's-dynamic-body and make each one of US CBDC issuance could happen] the Lawmakers have to resolve the frame and the Senators have to vote at The US Capitol, regulations for {the legitimate fertilization, the logarithmic impregnation without violation, the ownership with inter-vivos endorsable power and the mortis-cause transmission of thnese objects in themselves already dynamic and digital all with uppon records of the chronology of the actions and automatisms and also with the counting of the unit production time including the differences introduced by optional use of the #tagvaporator caractherizator in the PSH-Personal Savings Helper application menu on each do-g-phone}.

I expect and trust on Google's decision to make happen the convenient Android PSH-Personal Savings Helper app whose code compilation would constitues big light for Lawmakers' job.

Then the application spacial on over the world countries would require specifique agreements and ongoing enlargement of protocoles.

Because it is easy to foresee the immense success of this disinfectant digital dollar, an expander of general economic resources, a bringer of peace because the individual folks well-being could be solved by accomodation of this accomplishement.

20220622

15. Should a CBDC pay interest? If so, why and how? If not, why not?

Filipe's answer :

A CBDC has not to pay interest.

Because the interest rate (2%/day/365 daily payed) is use only to be transformed in a shared generator of cash results, with individualized times at production and a WUW's algorithm for the aplication of daily results upon UUS$$ digital objects with capital gains for everybody owners.

These capital gains are prefered to the attraction of an interest rate which mechanics is inflationary as knone.

In fact the phrase "A CBDC has not to pay interest" is used because in the preconized design for the US Fed's CBDC the people's action over money date-valuation provoque a capital flow growing atraction in shifting asset process conducting to digital objects property asset in digital savings ownership registered .

And in this shift asset process, the interest rate is used a purpose of production, going to the real target which is to make happen "capital gains" and "capacity to multiply" in liquid phase, fertilizing some dinamized cash to produce much more cash .That sprouts ing as an output for people using data-valuation as an investment substitute.

And in this shift asset process, the interest (preconized to be fixed for good at day a day payable rate of 2%/day/365) is used, at Fed's anchor [The Universocial Sovereign Anchor], as motor of production , going to the real target which is to make happen "individual capital gains" and "individual capacity to multiply" cash-in-much-more-cash both two outcomes to be applied each day (at T.O.M. The Timestock Owned Market 12:00 New York local hour) as new type of remuneration for persons using data-valuation creating "digital savings" giving substance by Fed's authorized digital dollars on legal tender.

Now in my opinion the CBDC of US Fed's should no pay interest by the fact that the payment of interest is an inflationary pratice which main objective effect grows in direct proportion with the rates grow and it application durability. Also introducing a parameter with determination of conjunctural evaluation and therefore of uncertain reach in volume in reason of the dose only approximate.

In my proposed construction design for US Fed's CBDC the thing is treated as follow :

A - Application of a recipe to produce capital gains from interest at a forever decided by Fed's fixed rate ;

B - Determination on the WUW's algorithm on it application policy with rules for the applicaion of the cash results produced ;

C - Creation of a time market, whose first would be The T.O.M.;

D - Use of Google Cloud Platform computacionall and techno-structural service inside of WUW's algorithm including solution for self feeded perenity in running costs, to achieve an app like PSH-Personal Savings Helper (Android's & WUW's deal) able to give folks a free motor to help them to better perform in their economic activity. It would be the on WUW's service of personalized BPaaS.

The all above, justify the substancial terms but yet without wiki definitions :

#cashkeeping phase ;

#owndated webquantum ;

#digital savings ;

#webcashmatic mode ;

#webtaxmatic mode

and a set of terms to explain the upgraded Economy 4G3W.

At the end, my construction allows my offer to the US Fed through #Googledepending of my final project worked by Google in it standars if so could by also for W3C and for US Admnistration.

20220621

16. Should the amount of CBDC held by a single end-user be subject to quantity limits?

No limits in my construction of US CBDC the processable UUS$$ digital.

Everybody may shift the asset from currency or banks balances at Central Bank of United States of America into Universocial US Dollar Digital Object , becoming owner and go back at any time without any cost or risk of loss.

In fact "this everybody" is to be refered at all persons with identity registered at the WUW Ledger by filling form unique condition for using the money data-valuation ability in form of personalized BPaaS through the app PSH-Personal Savings Helper. Being the PSH personalized ability for creation of digital savings objects through Fed's gate operational requirement of legal tender authorization for the monetary burden (US$ 10.- /each 1 O.W. digital savings object) allocation with creation of 1 unit of UUS$$. This shifting asset operation is goes on and follow to be computed by Google's Technical Cloud Service operating simoultaineosly at Universocial_Sovereign_Anchor, at WUW The Webcash,at TIGTA-Inspection and at T.O.M. The Time Owned Market.

Note & execution requirement of WUW's algorithm : The US Fed is invited for the kickoff creation of the Universocial_Sovereign_Anchor by allocation of a monetary financial magnet of 1 US$ trillion (US$ 1'000'000'000'000.-) on 100'000'000'000 Owndated Webquantums digital objects being UUS$$ 100'000'000'000.-:

1. Limitation is for Fed with agreed obligation of gradual unloading and recovering the used support in function of temporary magnet with decreasing force of attraction until neutralization ;

2. When US Fed recover all it kickoff support, The Fed and all admnistration also, get freedom for using data-valuation on the conditions offered to everybody.

Subscribe to:

Posts (Atom)