20221016

Using the production of interest to reduce the interest rate, can it be the solution to exterminate inflation?

Yes, this is the solution presented with the proposal to practice the data-valuation of money following the Webcash algorithm presented to the US Fed suggesting design and the substance for the body of the expected US digital dollar.

It's about giving people the opportunity to save with 1 click shifting the current dollar asset into a digital dollar in registered property asset.

For each person, valuing the US dollar data is equivalent to adding the monetary utility, the financial utility, the tax freedom utility, and the spiritual peace utility. All in a free webmatic operation with the personalized creation of the digital US dollar.

Any individual or legal entity downloads the PSH-Personal Savings Helper application and puts the Webcash algorithm to work to multiply money, conducting it Personal Business Process as a Service on the Google Cloud Platform pipelines within US Federal Reserve standards.

20221007

Could digital dollar become an inflation exterminator ?

Yes, indeed it is one of it attributes.

Because the digital US dollar is the US dollar shifted into digital property asset with your name as it creator and with a counter of time since your creation date

With this digital design, the US dollar become a property registered at your name containing the handles for wealth extraction from full body of your money : the function for monetary utility, the function for financial utility, the function for webtaxmatic utility and the function for spiritual utility.

Your economic action starts with the download of your P:S.H.- Personal Savings Helper app able to guide each US$ 10.- or multiples into de Internet working in your Business Process as a Service running on Google's Cloud Platform to automatize your creations of digital dollars by data-valuation of your fiat dollars.

And when with your fiat dollars you receive the advantages of it monetary function and you give away it financial function even when you stay responsable of your taxable rents, now with your digital dollars creations authorized by The Fed and guided by Google, you receive the advantages of all the digital money qualities running by the algorithm of WUW The Webcash Universocial Web.

And why is the digital dollar an inflation exterminator ?

Because the digital dollar require a creator person, like you.

Using your app PSH you have to date your creation act. And your PSH app obeys your shift asset order starting from fiat money which goes at the Universocial Sovereign Anchor at The Fed to be linked insuring production at the cash-sharing-cash factory and guaranty for your reversible order to the inicial state.

The infinite money production at The Fed's Anchor for distribution of day in webcashmatic mode of fiat dollars results, proceeds by immobilized accumulation on cash production and growing desinfection of fiat dollars (and other foreign fiat money). At The Fed's Anchor the cash-sharing-cash production is at 2% by fixed and interest payable daily by The Fed at the Time Owned Market for the owners of US digital dollars with distribution results rights on each application .

20221002

Should You Exercise All Your Power Over Your Money ?

Yes, as long as the action is legitimate and within social respect.

Yes, you have to do it.

How can you exercise all your power to better perform on Economy 4G3W ?

By your own creation of US digital dollars.

This presentation is proposed as a description of a possible digital transformation of money revealing the design for a personalized digital US dollar with universal utility and provided with handles working at time on :

the monetary field

+

the financial field

+

the taxmatic freedom field

+

the spiritual peace field.

For example :

Can you tell the Fed Federal Reserve that you want to exchange the dollars it issues for digital dollars authorized by it but created by you at a date as a result of the exchange and with reversible condition?

This universocial digital dollar ( UUS$$ ) is created by people who join the three constituent elements into unique digital units using the app Personal Savings Helper delivered for free by the :

1 monetary charge of US$ 10.- ;

1 time-date of the digital creation action;

1 US Federal Reserve Authorized Breeder ID.

How should be the US digital dollar

1 US Federal Reserve Authorized Breeder ID.

This UUS$$ universe digital dollar is created by people who merge the three constituent elements into unique digital units:

How can you act over your money's data ?

Taking in your hands your money's destny.

First of all to act over the data of your money you have to decide :

- When, or the moment (date) of your economic action ;

- How much, or the quantity (amount) inputed on your economic action ;

- Which direction, or target choosed for the kind needing satisfaction .

When you are on decision determination

And the monetary-financial-pump has to be connected with an interest production factory gaving folks remuneration a one-click-helper-to-save. Google S may connect you at financial cloud platform.

Because the interest factory (The Fed's Universocial Sovereign Anchor) giving folks the opportunity to keep the cash phase on created digital savings (on monetary part 1), while in financial process each person shares cash production (on financial part 2) to get the right to share in cash results every day at 12:00 at the New York T.O.M. where folks offer (Bid & Ask) time contained on personalized digital savings endosables properties.

20220819

The guts of China's digital Yuan e-CNY don't match the US Fed's DNA

China's digital Yuan is not processable under the Fed's required US digital dollar standards. It's the currency's DNA question.

An e-CNY digital currency wants to serve a top-down driven economy. The other UUS$$, admissible by the US has to serve a free economy for individual human handling decision or bottom-up.

Draft legislation that seeks to induce more momentum in the US Fed to launch the digital dollar to compete with rivals such as China e-CNY.

..."Democrat Representative Maxine Waters has drafted legislation that aims to have the Fed further study the prospect of a digital dollar and create a path for it to come to fruition, The Wall Street Journal reported "...

It would be nice if the US Fed were willing to launch a digital dollar stagnant in an inefficient design that doesn't contain the essentials of the US dollar's innards. These guts of an energetic, healthy and strong nature, presenting all the useful resources for their handling by people and appropriate for Well-Being.

It is already clear that e-CNY does not teach content that could serve the US Fed's digital dollar. Simply because the guts of the Yuan are not the same as the guts of the dollar. So, expressing these 2 currencies similarly or simply admitting that the digital Yuan precedes the digital dollar is an understatement.

To launch the US digital dollar the design must contain the concept of universociality and the complete processability in individual human hands.

It's easy to see that such design has to allow the construction as proposed at usafed-got-uusdigitaldollar.info .

20220730

UUS$$ is Human centered for performance handlement

Fair data principles

Data management to be used on US CBDC digital dollar predictible aims to be an open conduit leading to Human economic utility output to knowledge discovery and innovation on data-valuation for the Central Bank currency creation on standards allowed on the Economy 4G3W design, and to subsequent data and knowledge integration reuse by the community after the data publication process.

20220728

What is the better design for the US CBDC digital dollar ?

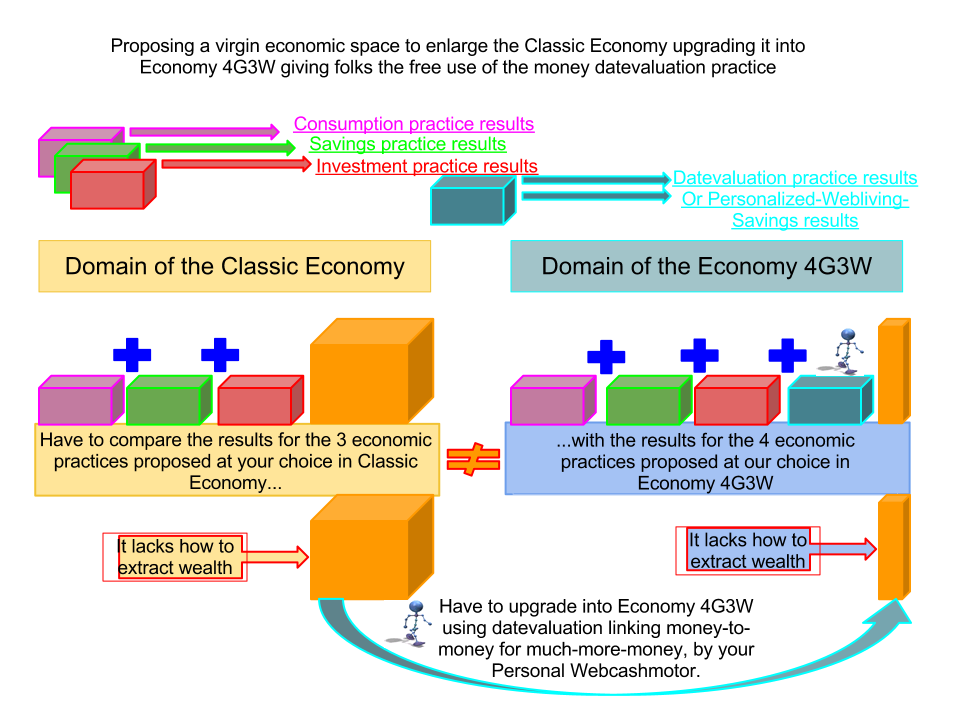

The economy-4g3w aims to become an upgrade to the Classic World Economy giving humans the opportunity to add the economic results of the money data-valuation practice, to the results of the other 3 economic practices, consumption, savings and investment which total result expresses the Economy as it was possible and limited before the Internet. Internet in standards of W3C brings the space, the dynamic and the ever evolutive production factors for humain exercise the money data-valuation practice in order to extract wealth from a virgin infinite resource.

So data-valuation requires the Internet to deploy effects that are results of individual activity over the money in digital form and maintaining it cash phase (#cashkeeping phase) that lives in reversible form of personalized digital savings.

It's this shifting of the fiat money asset into the monetary property asset of 1 digital object for each US$ 10.- (merged with the timestamp of creator's action), results in the Personalized Digital Savings is accounted with metadata and time and produces efects for the ownership creator.

Enabled people can create digital savings (US Fed's CBDC or digital UUS$$) using a PSH-Personal Savings Helper app delivered by WUW, The Webcash Universocial Web by a free inscription of the personal identity on WUW's Registry General Ledger that triggers and grants de license with personal habilitation by app identifier delivery.

From download allows the user to merge time as a commodity with the allocated money for datavaluation and the all the activity results are accounted anchorized at The Universocial Sovereign Anchor as digital objects in sharing cash production monetary work with saved guaranty in cash phase. Here at the Sovereign Anchor the dynamic generation of time-at-work metadata further of quantitative cash production to share day results, produces also the seniority coeficient which is the point of origin on added value formation on the body of each #owndated-webquantum.

Having shared on cash production, the digital savings units (each of them a singular digital object) go on coexistence at T.O.M. The Time Owned Market for financial work. Here all digital objects (supposed digital dollars objects) are units of capture of shared cash results. First using luck to random for their owners cash results : 100'000 digital units take each day all 80% of the TotUnixTimeCashCake ; after ordonating by seniority coeficient to fix the cash quantity for each one of the lucky 100'000, from the older to the younger slices results decreasing and are #webcashmatic payed after #webtaxmatic liberation with TIGTA inspection and freedom on personal cash results .

At the end, the last but not the minor, at The Time Owned Market there are organized one Bid & Ask on cloud market displayed at the screen of each do-g-phone (where there are a menu for time-at-market orders and for #tagvaporation uses). For the user it's the opportunity to sell time and other metadata contained on each digital savings object. This is the advantage to make capital gains without having take a risk and far of cash phase like it has been the compulsive obligation on investment practice in the tradicional Economy. This compulsive obligation to enrich is solved by the money data-valuation here proposed in economy-4g3w (4 four gestures in Internet www) .

20220727

The money data-valuation is the egg of Columbus

The use of the data-valuation practice aims to give people the opportunity to act over the money keeping it phase cash along computacional algorithm treatment to obtain #webcashmatic results in mode #webtaxmatic.

The algorithm is proposed by WUW The Webcash Universocial Web to be runned by Google Cloud Platform working on all the four parts of money, after shifting it asset into personalized digital savings in property asset and allowing to extract wealth in cash from entire money body :

1. from it monetary part ;

2. from it financial part ;

3. from it spiritual part ;

4. from it taxmatic part.

The money data-valuation is an economic upgrade and should work with the other three money practices : consumption, savings and investment.

With data-valuation people starts in Economy 4G3W (4 gestures in WWW).

20220725

Requesting the US Admnistration and in particular, The US Fed

Requesting the US Administration and in particular, The US Fed, the individual legitimity reconnaissance to praticate of the money data-valuation.

Because US dollar data-valuation gives folks liberty to operate all four parts of money body, upgrading personal economic performances, resolving the Penrose triangle limitation :

Money you spend for live, money that you can't save and money you neither can invest ;

Money you save for safety, money that you can't invest and money you neither can spend ;

Money you invest for reproduction, money that you can't spend and money you neither can save.

This limitation has not only a bad consequence economic performances, the worst is the regret for a bad choice and the development of feelings of guilt, often leading to introspective shyness and even chronic psychological illness.

Now on Internet Era evolution, the US Lawmakers should frame the personal right to shift the US dollar asset into personalized digital savings activated with internet dynamics. Hugging the design of Fed's US CBDC or US digital dollar, even one UUS$$ prepared for universocial digital dollar on world markets. Money on folks hands with four processables parts working in Internet for people wellbeing upgrading our Classic Economy making the data-valuation of the US$ and creating the US CBDC .

20220723

Predictive app for the creation of US Fed's digital dollar CBDC

More Recent Articles

- Should Google accepte the challenge to launch the money data-valuation practice giving substance to the US Fed's CBDC ?

- Concepts for US CBDC

- 2. Could some or all of the potential benefits of a CBDC be better achieved in a different way?

- 3. Could a CBDC affect financial inclusion? Would the net effect be positive or negative for inclusion?

- 4. How might a U.S. CBDC affect the Federal Reserve's ability to effectively implement monetary policy in the pursuit of its maximum-employment and price-stability goals?

It's time to monetarize time from your digital savings

20220719

Should Google accepte the challenge to launch the money data-valuation practice giving substance to the US Fed's CBDC ?

The money data-valuation aims to be an economic practice allowing people achieve the constitution of personalized digital savings.

Personalized digital savings could be created as digital objects in property asset of their creators or of their sucessives owners having adquired at a later date the evolutive rights by transaction among the living or by cause of death.

What are the economic solution that could be resolved by the use of the money data-valuation practice and by it digital savings product ?

The economic solution is on the mode to obtain capital gains from the money in savings phase. The money data-valuation is a practice that starts from using cash, for cash interest production to share cash results every day.

The money data-valuation is available in Internet space. It uses a "PSH-Personal Savings Helper" app to run an algorithm to be conduct by Google Cloud Platform service that :

- Works in cash phase for results in cash phase ;

- Delivers day #webcashmatic results from all 4 utilities of digital savings properties ;

- Delivers freedom by it #webtaxmatic function inspected by TIGTA.

20220718

Concepts for US CBDC

The technologic problem of the creation of the US CBDC is a false question.

The problem was the conception but now it is understable that:

For people the liberty to be able to shift the asset of the US dollars into the personalized asset of the US digital dollars, brings the opportunity to make digital savings containing in it substance all the set of money’s utilities : monetary part, financial part, spiritual part and taxmatic part. So the US Fed’s CBDC got people’s preference and the US digital dollar succed sucession of US dollar.

So the design proposed to FED requires W3C’ and Google’ wills. Both working for people welfare.

And this sentence resolve all the design because it clarify that the US CBDC has to take origin on people’s needs and wants. To satisfy persons. All persons, not some.

So the design proposed to FED requires W3C’ and Google wills for the creation of a web cash for economic upgrade introducing the practice of the money data-valuation.

At WUW The Webcash Universocial Web we are proposing to Google and the United States Administration through the Fed, the launch of the United States CBDC using a simple design that manages to merge time as a commodity in the US dollar turning it into digital saving.

Giving people the ability to exchange money into a personalized asset in the form of a cash-producing cell anchored at The Fed = would become the US Federal Reserve’s CBDC.

Then at T.O.M. The Time Owned Market all webcashmatic results are distributed every day at 12:00, under TIGTA inspection.

20220707

2. Could some or all of the potential benefits of a CBDC be better achieved in a different way?

2. Could some or all of the potential benefits of a CBDC be better achieved in a different way?

Filipe's answer :

The benefits that should be achieved with the launch of the US CBDC may be more important than those considered in your January 2022 paper and be specific to the Universocial US$$ of the FED, by introducing the notion of an automatic work on the data of the money to be created as 1 by 1 digital objects with unique characteristics and just shifting the asset from credit-debit balances to digital property asset registered at a sequencial historic general ledger.

The notion to be introduced and already tested is the processing of money in different parts of the body of the digital object.

Indeed...

Let us inject time into the money, fusioning both with the creators identity of digital savings objects.

That shifting asset action (data-valuation) could let people go cash sharing the production of cash results (distributed every day), using Android app to personalize dynamic savings and to trade timestock in savings in production of interest generating capital gains by Fed's anchorized production fabric in universocial web space.

It's the WUW's algorithm runned by GCP with agrement of W3C, US Admnistration and Fed as co-issuer-legitimator.

3. Could a CBDC affect financial inclusion? Would the net effect be positive or negative for inclusion?

3. Could a CBDC affect financial inclusion? Would the net effect be positive or negative for inclusion?

Filipe's answer :

Considering in the first place the possible launch of the US CBDC as a liability of the central bank and fearing multiple launches of similar CBDCs, I have the intuition of certain storms in the field of financial inclusion where the US dollar digital presupposed in your paper of January 2022, even if with unmistakable value support, it may lack the simple features that I see in the launch of USA FED's CBDC or Universocial US$$ giving it in a way linked to the value support:

- as cash production cell (1st monetary part processable as personal savings growing advantage ) +

- a counter @stamping of the time in production of the cell and its antiquity in the production of distributable wealth (2nd financial part processable as capital gain as the time go) Time Market Bid & Ask +

- a webtaxmatic cloud function as a release value of the webcashmatic income of the new taxable amount that the US Treasury thanks (3rd part processable as "freedom" gain) +

-a tagvaporator of the personal orientation option for the free exercise of the owner of the digital object UUS$$ regarding the eventual limit destination (democratic folks control of investments) of the monetary load allocated in the "Universocial Sovereign Anchor" which production is distributed every 24 hours (4th part processable as "multiplicative capacity" gain).

|

20220706

4. How might a U.S. CBDC affect the Federal Reserve’s ability to effectively implement monetary policy in the pursuit of its maximum-employment and price-stability goals?

4. How might a U.S. CBDC affect the Federal Reserve’s ability to effectively implement monetary policy in the pursuit of its maximum-employment and price-stability goals?

Filipe's answer :

The launch of US CBDC designed as "...a digital liability of the Federal Reserve that is widely available to the general public" could affect the Federal Reserve's ability in the pursuit of its maximum-employement and price-stabilitty goals.

Because such CBDC would not be USA genetic but one more CBDC and would lack not only of an underlying asset pool as the others even not so important for United States of America and it futur digital dollar but moreover it lacks of an underlying construction to enable folks on ability for wealth creation and extraction from the virgin space self dimensionable with UUS$$ and a fixed interest rate for the cash production to be shared to get rights to share cash results every 24 hours.

Estas lacunas evendenciam dúvidas sobre todas as cryptos and less but also sobre all CBDCs as it's coming before me.

In my proposed design of FED's UUS$$ for United States of America the "digital liability" would be "FED's disponibility of economic spaces for anidation of central bank money in web dynamics production" creating conditions to generate a stream of money now again towards the FED !!! and to rearrange the Universocial Economy.

Now the Federal Reserve’s ability to effectively implement monetary policy in the pursuit of its maximum-employment and price-stability goals, could be better performable with the introduction of the Fed's U.S. CBDC in reason the dynamic exudation of new smart tools contained on it substancial nature and generators factors for quantitave issuance.

On my design, Fed (if not before, a Fed's onecompetitor ) might create a monetary-financial magnet in form of an unit (a factory) of interest production from US$ 1Trillion cash accumulative by the persons who could be interested to share on that production (linking money), against [guaranted cash results distributed every day, + the hopes with day capacity to multiply + certainity of capital gains as the time go].

Giving folks the right of revert it action of money data-valuation gesture. The thing substantiate and motivate as in any case, personalized digital savings guaranted by The Fed.

The sketch of the US CBDC design pleases but seems unrealizable.

The fact is that US Fed can achieve the launch of the US CBDC, the digital dollar with unique and exclusive virtues.

The American CBDC shall be unreachable for the competent on the present and on the future, because designed and defended for universocial well being.

Nota Bene : on the WUW's algorithm the initial capital of 1T US$ to constitue The Universocial Sovereign Anchor is designed as coming from Fed ( may be with anidation or accounted as active or as passive at US Treasury) contains an irrevocable obligation to phase out to zero. From zero, The Fed becomes free of that obligation and can decides about the opportunity to use it own PSH-Personal Sav

5. How could a CBDC affect financial stability? Would the net effect be positive or negative for stability?

5. How could a CBDC affect financial stability? Would the net effect be positive or negative for stability?

Filipe's answer :

It would be positive or negative for stability in dependence on the CBDC design.

I would trust a UUS$$ as FED's codificated spaces to be created at the General Ledger of The Webcash Universocial Web" as FED's authorized spaces for anidation (reversible allocation) of folks monetary burdens who use the PSH Personal Savings Helper for the practice of the money data-valuation.

US CBDC as FED's a liabity would not be great to resolve inflation and USA Debt ( no so important I agree but would prefer an organized in inflation compressor and investment resources cash stream for people wellbeing and to maintain USA leadership.

Now, what should be the meeted brain point to judge for US Fed's final decision when looking on the designed and proposed standards on one US' CBDC with positive factors of stability ?

The Fed's Board of Governors has done a choice over the stability factors prefered by politic options framed by actions compatibility.

In front of the set of commands in evolution at The Fed, the creation, the adoption and the launch of the US CBDC, should accept a design with a mix of stability factors in accordance with independent intrinsics panel of economic influencers elements :

- towards positive impulsion economic effect :

adoption value , 40% ;

- towards positive impulsion competitive effect :

adoption value, 20% ;

- towards positive impulsion of desinfection effect :

adoption value, 40% ;

Analizing the nature of the design along proposed in concordance of this panel of values for adoption and launch, it is possible to infer that the net effect of Fed's CBDC launch would be positive, even though despite the initial winds caused by massive popular support.

20220704

6. Could a CBDC adversely affect the financial sector? How might a CBDC affect the financial sector differently from stablecoins or other nonbank money?

6. Could a CBDC adversely affect the financial sector? How might a CBDC affect the financial sector differently from stablecoins or other nonbank money?

Again in dependence of the CBDC design.

A design where the US FED authorize the use of an infinite number of it coded spaces for anidation alphanumeric and @stamped of monetary burdens to be provided of WUW's algorithm for the money data-valuation reproduction seems the opportunity to serve USA with a pioneer central bank currency driver included the processed money pumping by Google Cloud Platform in stream for the Universocial Sovereign Anchor of shared cash production at The USA FED and with cash results every 12:00 at New York local hour at The T.O.M. The Time Owned Market.

Could a CBDC adversely affect the financial sector?

Adaptations with upcoming reaction events would be daily webmatic treated by the total transparence of the WUW The Webcash and The T.O.M. The Time Owned Market and all insuered by Google's Technical Structure.

Bearing in mind the principles to be followed in order to achieve the set of solutions required for the general satisfaction of social, economic and political needs, the design of the US Fed CBDC cannot deviate from the one I present to you.

So much so that the best thing would be to start with a working group to prepare the post-test M.I.T. and in secrecy.

In fact, the needs to be satisfied cannot wait:

As for individuals, legal entities and even entities, in the social sphere:

- How can budgets be used in order to live?

- How can growing investment needs be met without promoting popular savings and without having to remunerate them with the highly inflationary "interest rate instrument"?

- How can you start and achieve the disinfection of money "separating the wheat from the chaff"?

- How can you restore a balance between the monetary and the financial to people?

- How can people be given happiness and freedom by encouraging and supporting them in economic life?

As for the economic ones and as for the issuing institute:

- How can the Fed's US dollar be maintained and hegemonized?

- How can investments be fed without having to create currency in a hyperbolic trend?

- How can commercial banks and central banks that are not in line with the US Constitution be put back at the service of the society sheltered by the US army?

- How can infinite wealth be extracted from an Internet Web space?

- How can the US$ be digitized without disturbing and without harm?

As for the policies and as for the US Constitution:

- How can an advantageous CBDC be regulated to progressively replace the US dollar?

- How can we ensure that the framework for the "legal trend" is fair and comprehensive in terms of the existing socio-economic, monetary and financial structures in the pre-launch of the new digital currency?

- How are the elements of the US CBDC eligible as tax makers and what are the supervisory bodies?

- Must the law authorize the Fed to use Google's infrastructure

for services inherent to the issuance, operation and automatic computer circulation, including tax refunds to taxpayers from other countries?

- The legislation must be designed with a provision on a confidential basis for a launch that may come as a surprise to the Market.

In fact, I present to you here the ingredients of the solution

1. Liquidity preference, the solution is "#cashkeeping" ;

2. Satisfying "needs and wants", the solution is "#webcashmatic" ;

3. Being a producer of daily results, the solution is time for action;

4. Being a wellness producer, the solution is "#webtaxmatic".

The structure that should support the proposed design for the launch of the US CBDC requires:

To the founding by the Fed and the acceptance of the US CBDC design,

1. Formation of Universocial Sovereign Anchor" with 1 Trillion US$ serving as a cash production device for daily distribution and as a temporary magnetic magnet offered publicly to share results on an individual basis from "sharing cash production" to "share cash results every 24 hours", and :

in the broadcast,

- At the decision point of the CBDC issue: people practicing "the money data-valuation" using the Android app "P.S.H.-Personal Savings Helper", change the asset from US$ 10.- to a digitally owned asset = 1 Owndated Webquantum that contains the name of the creator combined with the monetary charge and with the timestamp of the property created with authorization from the Fed and assisted by the WUW The Webcash algorithm with internal and external Google Cloud Platform service with W3C agreement and performing general execution from end to end including the postage of round trips, to Mercado do Tempo, the Bid & Ask service, transactions, delivery of payments, always in the #cashkeeping phase and the performance of functions in the #webcashmatic and #webtaxmatic modes.

Now finally answering your title question:

The inconveniences and disturbances will have repercussions on the monetary and financial markets, which will see a decrease in the income derived from the current issuance system by Tbonds.

The advantages for all are found in the improved Economy with the practice of "the money data-valuation", its infinite benefits for all, its instrument for producing an interest rate forever fixed at 2%/day/365 payable every 24 hours, its power to create an unenforceable fiscal mass.

20220702

7. What tools could be considered to mitigate any adverse impact of CBDC on the financial sector? Would some of these tools diminish the potential benefits of a CBDC?

Filipe's answer :

The tools are considerated in standards of the USA FED and could insure full succès for implementation and to run the W3C Internet, drived in handleling by Google's Tech Services :

- Draft protocoles and execution agreements ;

- Regulations of US Congres ;

- Creation of FED's codes for authorizing anidations at the WUW's

General Ledger ;

- Implementation of WUW The Webcash Universocial Web ;

- Creation of the T.O.M. The Time Owned Market ;

- Creation of the app P.S.H. - Personal Savings Helper ;

- Creation of Do-G-Phones specifiques for to run PSH app ;

- Testification phase at MIT.

- WUW's notary documents for operations over digital properties "Owndated Webquantums".

.../...

Some of the tools included on the process of constitution of personalized digital savings which is the lead wire (linking money-to-money by do-g-phone, on organized production cash shared, adding time in cash keeping phase to share cash results in #webcashmatic and #webtaxmatic modes) thanks to the creation and issuance of the digital dollar, with the two merged wil and synchronized on independent actions that starts with 1 personne (agent economic on firts kickoff creation step), goes to the US Fed ( 1 admnistrative institution for Monetary Policy Implementation) to offer integration on political directional needs asking authorization for monetary allocation with anidation for cash production at the Fed's dependent Universocial Sovereign Anchor.

A - The synchonized wil of both (folks each individual + US Fed's)

- by [(1 person in monetary covering action for webcashmatic & webtaxmatic results)

+

- by (1 institucional person US Fed's anchorizing cash production)] + WUW's (service of identity registration + data-valuation algorith + app delivery + running BPaaS on included internal service GCP IaaS by WUW's / Google / W3C protocol)] :

B - The 3 service providers :

- by WUW The Webcash ( service for beneficiary legitimation + P.S.H.-Personal Savings Helper deliver a+ algorithm running on BPaaS for the practice of the money data-valuation)

a+

- by T.O.M. The Time Owned Market (service of day results distribution

Sumission at TIGTA's inspection + service Bid & Ask on time market+ capital gains payments + WUW's Office of Regular Certifications)

+

- by Google' IaaS computation energizer and handling of general algorithmical executions enrouting from start inscription to the complete circuit of money parts and delivery of cash results depurated from tax obligations.

N.B. In order to assess the negative effects of a US Fed's CBDC, it is necessary to know the final design that will be adopted for launch. Staying in Classic Economy and refusing the money datevaluation as a mean to make capital gains without risk which practice is the main reason to defend the money data-valuation as an alternative investment substitute justifying the upgrade into Economy $G3W (four gestures at internet space) , it's not possible for me to answer in that past landscape.

Even so, uncertain as to your final choice, and yet without envisioning the principles adopted for the final design, I will venture to write an answer referring to the fundamental dangers and disturbances-or-not (when to arrive at the digital currency that would be the Fed's US CBDC, without incorporating time and without counting it in economic production, without a visible processing structure and used by the general public and sending 3-Stamp Economy and pre-internet) that I feel solved in my proposed project and that I do not see solved in another CBDC of US by Fed, whether it is before or after the others already in circulation and or still in classic preparation. Then answer for solutions that your CBDC would provide:

01. How does CBDC resolve the issue of savings sterility?

02. How does CBDC solve, cementing and fueling investment and it pressing needs for accelerated growth?

03. How to solve a CBDC, the interest rate versus inflation pair?

04. How do you resolve the costs and unattractiveness of government bond issues?

05. How does the CBDC, the control of commercial banks, resolve?

06. How does the CBDC solve, the necessary disinfection of the currency?

07. How is the CBDC resolved, the competition against US$ ?

It will be developed.

20220701

8. If cash usage declines, is it important to preserve the general public’s access to a form of central bank money that can be used widely for payments?

8. If cash usage declines, is it important to preserve the general public’s access to a form of central bank money that can be used widely for payments ?

Filipe's answer :

Yes it's important to preserve the general public access to a form of central bank money.

.../...

Attending to with the growing trend in the decrease in the use of cash, to the general preference pour la phase liquide when in safety, reliability and reversibility the creation of the digital dollar as the Fed's US CBDC has to preserve the general public’s access.

The US Fed's digital dollars to facilitate payments is advocated in the design proposed and discernible at set of answers hereby. Nothing better than a do-g-phone in folks handswith P.S.H.-Personal Savings Helper app because the dollars quality as been shifted into now reversibles digital dollars working in burden-allocation-covered cell cash , to make monetary production of cash, and are now digital dynamic properties with permanent acessibility by on-line owners.

The digital dollars (Owndated Webquantums as advanced US Fed's CBDC) Google' processed with The Fed and The Universocial Sovereign Anchor, with The US Treasury through The TIGTA, The Webcash WUW and The Time Market T.O.M. populate the Internet Webcash space insuring the personal Business Process as a Service in #cashkeeping phase and in the modes #webcashmatic for owners' income and #webtaxmatic for freedom and wellbeing.

All persons users of data-valuation dispose of it processable money in digital savings properties linked at The Universocial Sovereign Anchor, also at The Fed and also with a set of named entities here up .

N.B. : The processable digital dollar, works for all executions and self displayable flash position accounts using the verification of concordance of output resuls calculated on multi-synchonized-machines with independent standards of technology. Make'em go cash. Make me go digital cash.

20220629

9. How might domestic and cross-border digital payments evolve in the absence of a U.S. CBDC?

Filipe's answer :

That if absence of a U.S. CBDC.

Now considering one U.S. CBDC acorded between The FRB and Alphabet-Google with both acceptation of the schematique Filipe's design, with W3C standards as agreemented roof with the founders of WUW The Webcash and Time Owned Market on W3C standards, so :

Domestic and and cross-border digital payments could be made by titularity by endorsement of ownership in the historic accounting record of the WUW The Webcash Universocial Web `[benefiting from its internal protocol with Google] with update on the change of the BPaaS-Business custom's on wuw service Process as a Service (GCP by WUW).

It could give full satisfaction for both Fed-BIS and for folks users of the money data-valuation practice allowing the creation of Personalized Digital Savings properties (Owndated Webquantum) processables further than the clasic payments limits (the us fed's digital dollar could bring to the world "the notion of dynamic payments with in board shift asset".

20220628

10. How should decisions by other large economy nations to issue CBDCs influence the decision whether the United States should do so?

10. How should decisions by other large economy nations to issue CBDCs influence the decision whether the United States should do so?

Filipe's answer :

Agreements are allways the better solution even with the smallest nations.

.../...

The US decision to launch a CBDC is further a consequence imposed by the economical technology evolution, by the human uses of comunication and the fiduciary provisions around unstopable investments than a question of conjunctural competition between nations.

So I trust on US decision launching an upgraded and enriched CBDC in it conception. But the US decision will be generated at the Fed, then regulated and approuved to be isued without further delay.

The other nations CBDCs, or even those of 1 or more economic zones (in potential) could stay more and more unprefered in front of a dynamic and powerful US dollar, now in digital format, running by the "Google Cash Search" engine, served in the hands of the people who want personalized digital savings to be valued on the web and always cash available at no cost, containing monetary, financial, freedom qualities taxmaticas with free dynamic web bringing a multiplicative capacity in monetary personal hope achievable day by day even at millions in cash. All with the certainty of being able to trade increasing capital gains as time goes by increment of the cash production-day-distributed by do-g-phone function linked at T.O.M. The Time Owned Market.

The design proposed for the Fed's UUS$$, would contain one active liquidity of the personalized savings that should be modulated in the areas of ethics, economics and politics because this digital dollar would contain one overcoming attraction self generated (over the world's monetary liquidities) which coud (if modulated) resolve inflation for good.

Also the launch by US Fed of this future digital dollar with this visible and understandable design along the 22 answers gathered here as elements for tests facilities on the MIT @mitDCI (Digital Currency Iniciative) and at the Boston Fed or at Banque du Canada at least and before others laboratories. The launch should make available open and multinational scoped smart contracts for draft ongoing agreements.

Because even if the webtaxmatic function would had to be operated at USA by US Treasury the justice in terms of fiscality tax scope would be preserved.

20220627

11. Are there additional ways to manage potential risks associated with CBDC that were not raised in this paper?

11. Are there additional ways to manage potential risks associated with CBDC that were not raised in this paper?

Filipe's answer :

PSH-Personal Savings Helper should be an app whose Android construction follow the WUW's specifications

The specifications whose specifications are in the pre-beta phase and the list of steps to be programmed for the execution of the WUW The Webcash algorithm are open, due to the proposed protocols and still in the #googledepending phase for #determination of Google-Alphabet / W3C.

These protocols proposed by the WUW to GOOGLE are bilateral and tripartite agreements including the respective "standards" partially dependent on the will and legal frameworks (part of them in the future phase of the votes of the US Senators.

All of this is assumed in the highest level of security under present conditions and in the potential landscape associated with the launch of the US Fed's CBDC supposed UUS$$ digital US Fed's dollar digital in the form proposed here of a digital object to be created from the need to remunerate the savings of vigorously through the innovative path of automated gains both in capital gains and in the hopeful gains of a multiplier capacity in everyday life that serves the "Savings Helper" function (perhaps the function with the greatest curative and propelling consequences of the Economy).

Returning to the protocols , it can be seen that the actors requested by the Author and the WUW are:

1. Google-Alphabet (technical structure, service and evolutionary guidance;

2. W3C (standards and foundational requirements for "the webcash" and "the time market");

3. US Admin (US Treasury - Tiger - US Fed for regulations and individual authorizations for issuance);

4. Results appliance every day at T.O.M. The Time Owned Market : insuring the functions #cashkeeping, #webcashmatic and #webtaxmatic payements e o fornecimento das certificaçoes do WUW's Office for Public Certifications via personalized B.P.aaS conduct by Google .

Subscribe to:

Posts (Atom)